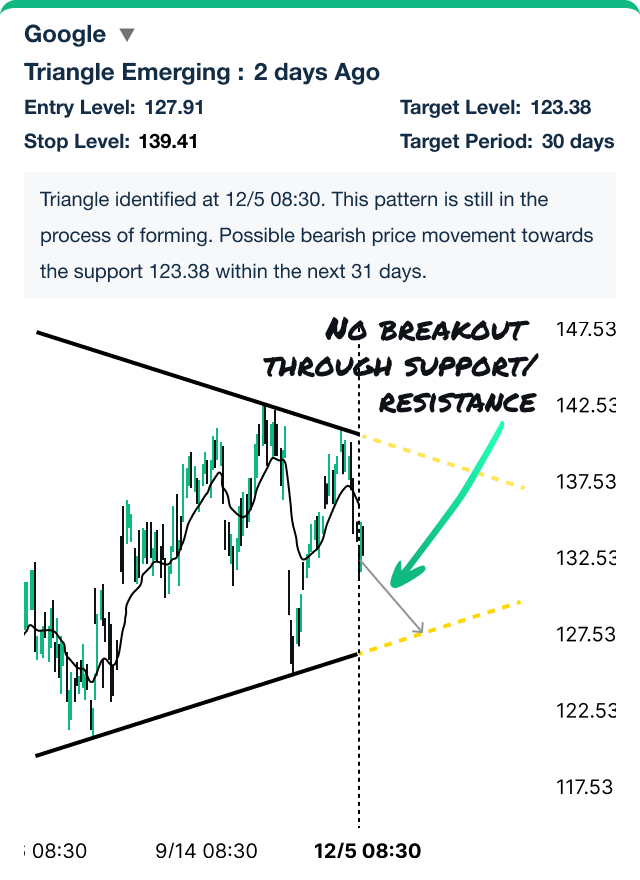

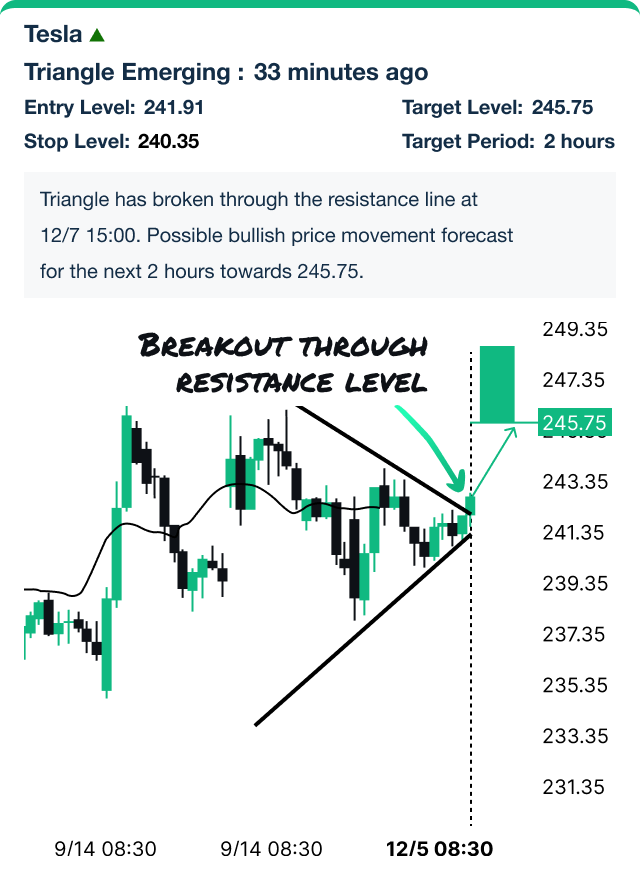

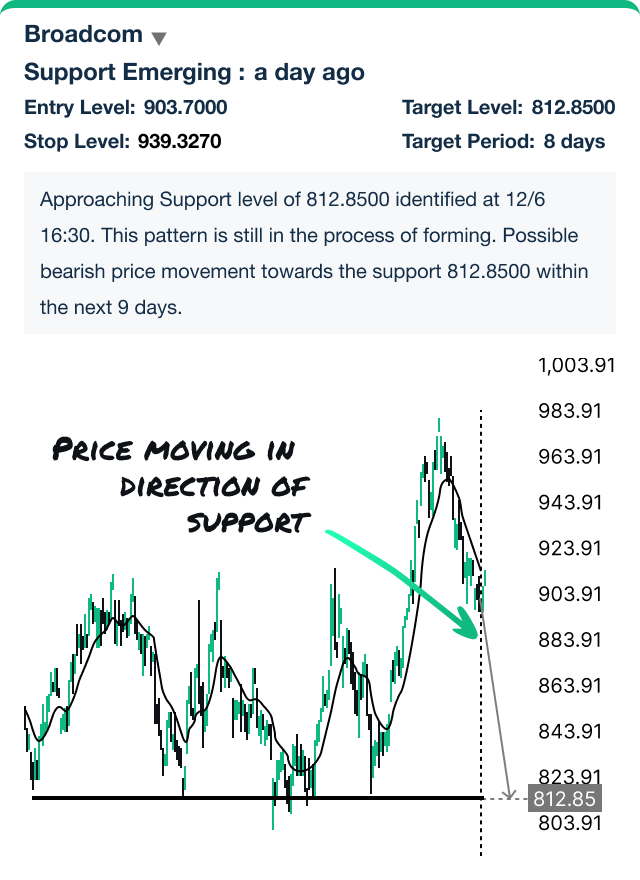

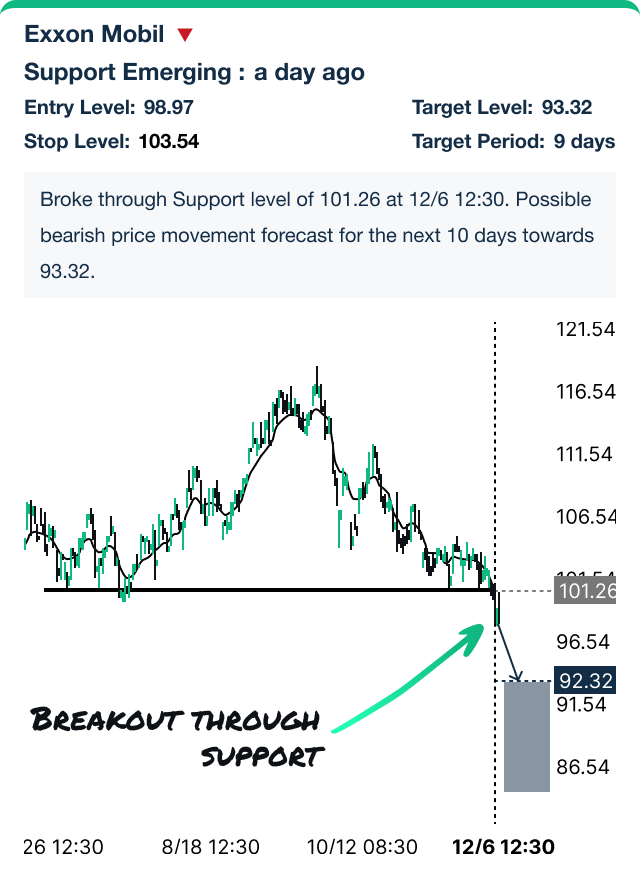

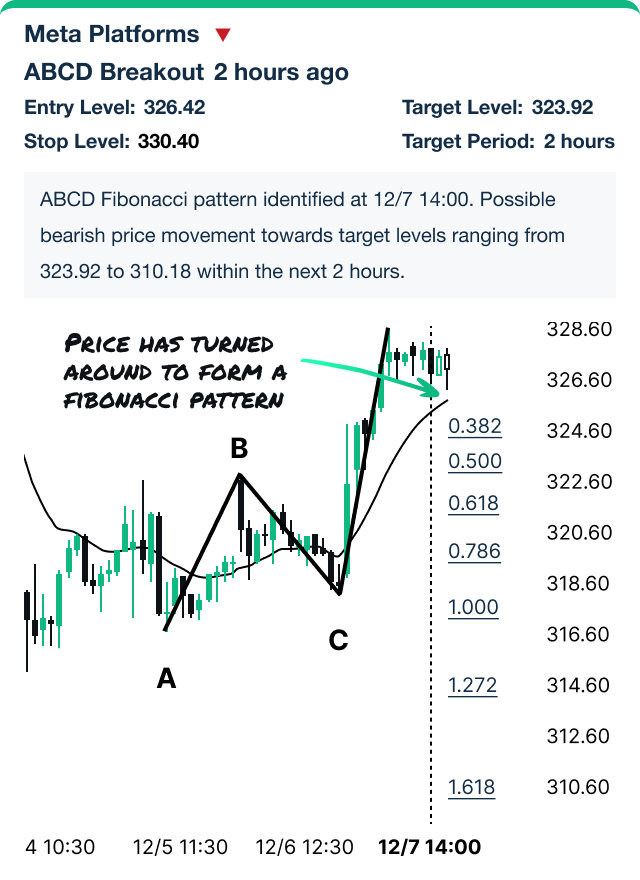

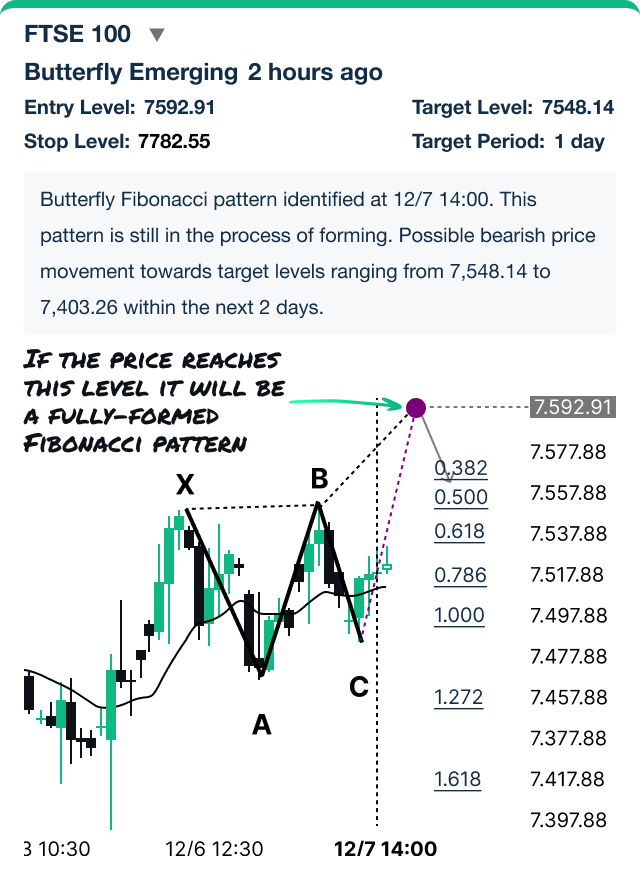

These technical chart patterns visually represent potential price movements. Some patterns signal a continuation of a current trend, while others indicate possible trend reversals. Autochartist identifies the most commonly traded technical patterns in the markets, including:

Tools such as Fibonacci retracements, extensions, and levels identify potential support and resistance levels. The Fibonacci Ratio helps measure the target of a wave’s move within an Elliott Wave structure. Different waves in an Elliott Wave structure relate to one another with the Fibonacci Ratio.

Autochartist provides an extensive analytics toolset with features to take your trading to the next level. Empower your day-to-day trading decisions with an unrivalled breadth and depth of analysis driven by advanced algorithms, powerful big-data technology, and user-friendly trading tools.